Fundraising requires a track record

Why Investment Managers Need a Credible Track Record

In the high-stakes world of asset management, credibility is everything. Before starting my investment fund, Clerkenwell Asset Management, I diligently recorded my trading history in a spreadsheet and maintained a daily P&L. Even though the results were strong, very few people outside my direct circle of contacts found them credible because, to them, these were simply numbers in a spreadsheet – I could have written anything there.

As the fund launched and began operating, it developed an audited track record that potential clients took more seriously. Of course, this came with a significant cost. The setup cost for the fund itself was more than $75,000. My administrator charged ~$40,000/year, and our annual audit, despite my best efforts at keeping costs low, was another ~$20,000/year. Another alternative I could have pursued to establish a track record would have been building a commercial index – this, too, comes with a $20,000+/year per strategy price tag and significant operational complexity.

This cost is unreasonable for many people looking to get started in the industry. But without a verified track record, it’s very difficult to attract outside investment. It’s a classic chicken-and-egg problem. So, what should be done?

This article considers why track records are important and what aspiring money managers need to consider when building theirs.

A track record demonstrates competence and experience

Source: The Hedge Fund Journal

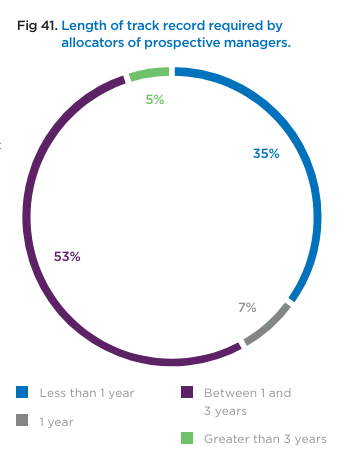

Because the product of a successful investment manager is good returns, clients rightly want to see whether a manager has generated strong returns in the past. A credible track record of 1-3 years is often considered the minimum to provide tangible proof of the manager’s skills, strategies, and overall competence, with a longer period generally required by institutional investors. This is particularly important when competing for high-net-worth individuals or institutional clients who scrutinize every aspect of a manager’s performance history.

A solid track record is the foundation of trust between investment managers and their clients. Clients who see a consistent history of sound investment decisions and returns are more likely to entrust their assets to the manager.

A track record enhances transparency and facilitates due diligence

Potential investors want to understand how a manager makes decisions and see evidence of those decisions’ outcomes. A verifiable track record offers transparency, showing not just the successes but also serves as the foundation for a story on the decision-making process behind those successes. This transparency builds trust and helps clients feel more connected to their investments.

Diligence is a rigorous process for institutional investors. They need to verify the authenticity of a manager’s performance claims. A credible track record simplifies this process by providing clear, verifiable data on past performance. This speeds up the due diligence process and positions a manager favorably in the eyes of potential institutional clients.

Good track records address survivorship bias and cherry-picking concerns

Investors are wary of survivorship bias and cherry-picking in reported track records. Survivorship bias occurs when only successful funds are reported while failed ones are omitted. Cherry-picking involves showcasing only the best-performing investments. A credible track record eliminates these concerns by providing a comprehensive and honest history of all investment decisions, giving a true picture of the manager’s capabilities.

Relying on brokerage statements for a track record is the popular simple approach, yet it fails to address survivorship bias and cherry-picking concerns. There’s generally no way for a potential client to know how many brokerage accounts you have open. Due to the simplicity of creating paper trading records, their credibility is even lower.

A track record should be maintained consistently over time

Even after a strategy is launched and an expensive and time-consuming audit is done, the problem is not solved. Investment managers often face transitions, such as switching brokers, changing custodians, or losing individual accounts or clients. These changes can disrupt the continuity of their track record. A robust and portable track record system ensures that the manager’s history remains intact and verifiable. This continuity is crucial for maintaining client trust and proving long-term performance.

Track records can be expensive to maintain

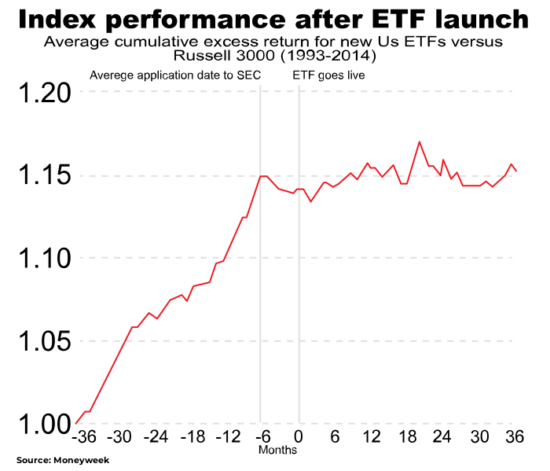

Traditional methods of verifying track records, such as seeking audits or launching indices, can be expensive, time-consuming, and operationally challenging. These are commonly held to be the gold standard of credibility, but their cost can be unattainable for emerging managers or even for established managers trialing new strategies. Furthermore, even indices are not immune from survivorship bias.

Fortunately, validityBase can help. If you’re interested in creating a fully verifiable track record that is free of survivorship bias and cherry-picking concerns, and if you are looking for a simple and cost-effective solution, contact hello@vbase.com to learn how we can help.

Conclusion

A credible track record is not an isolated document or set of numbers; it’s a powerful tool that is the foundation for trust, transparency, and enterprise growth. Managers with verifiable performance histories are far better positioned to attract capital and expand their client base.

Legacy approaches, ranging from inexpensive paper trading to costly and complex index launches, fail to resolve critical concerns around cherry-picking and survivorship bias. Fortunately, emerging technologies and products overcome these shortcomings with simple, low-cost, and credible solutions.

Recent Posts

Why Great Returns Don’t Attract Investors

Why Great Returns Don’t Attract Investors

Many investors are unable to convert strong returns into clients or capital. Learn why and how to fix it.

Mitigating BorgBackup Client Compromise

Mitigating BorgBackup Client Compromise

A compromised BorgBackup client allows undetectable tampering with past backups. vBase offers a simple solution.

Stop Using Brokerage Statements to Show Your Track Record

Stop Using Brokerage Statements to Show Your Track Record

Many traders use brokerage statements to create a verifiable track record. Unfortunately they are not credible for this purpose. A better alternative exists.